38+ mortgage backed securities definition

Web Remember these key points. Lets assume you want to buy a house so.

Mortgage Backed Security Wikipedia

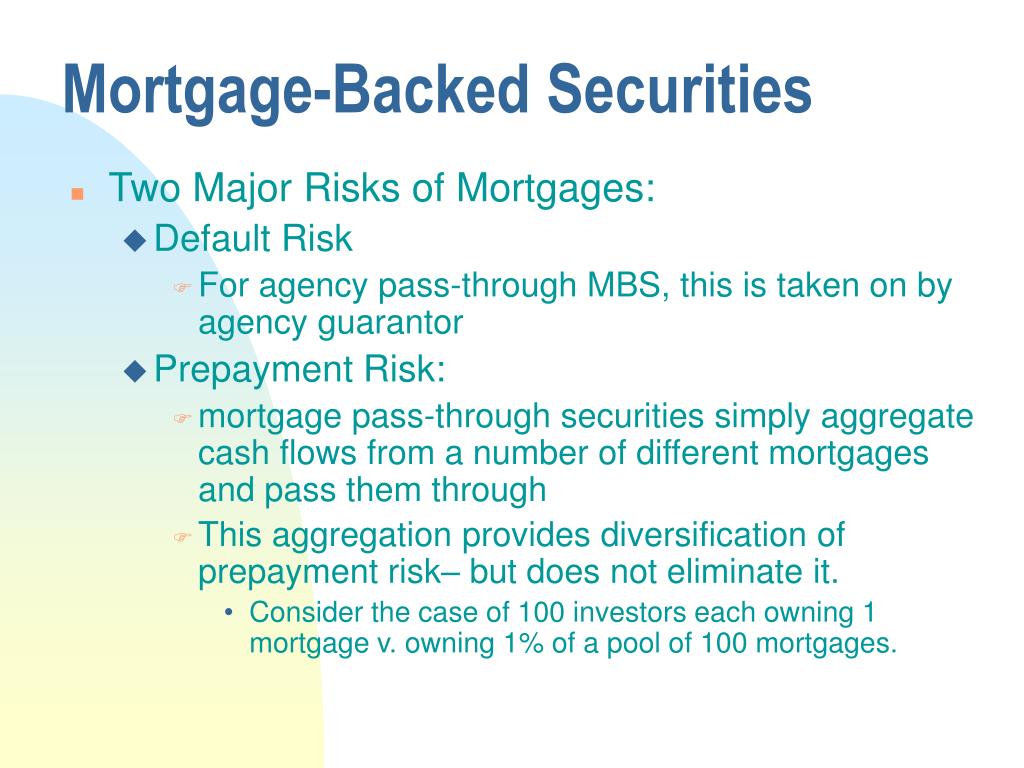

Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages.

. Web Mortgage-backed securities are usually priced in such a way that both parties the lender and investor benefit from the transaction. The value of MBS is secured by. A mortgage-backed security MBS is a bond in which an investor pays a lender for a mortgage.

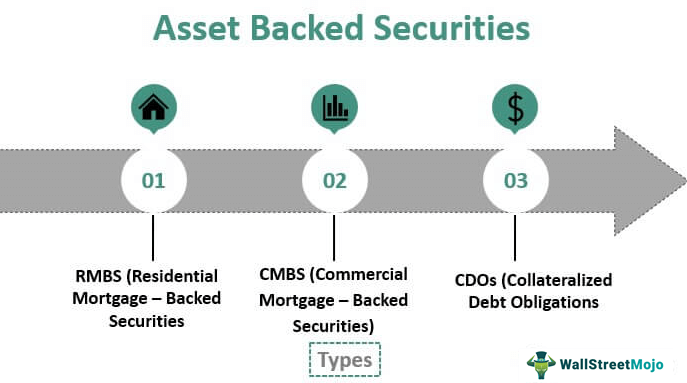

Web Asset-Backed Securities. To create asset-backed securities financial institutions pool multiple. Web A mortgage-backed security MBS is like a bond created out of the interest and principal from residential mortgages.

An MBS is an asset-backed security that is. Web Mortgage-backed securities are traded on secondary markets and the minimum investment can be as low as 10000. Web Asset-backed securities ABS are securities derived from a pool of underlying assets.

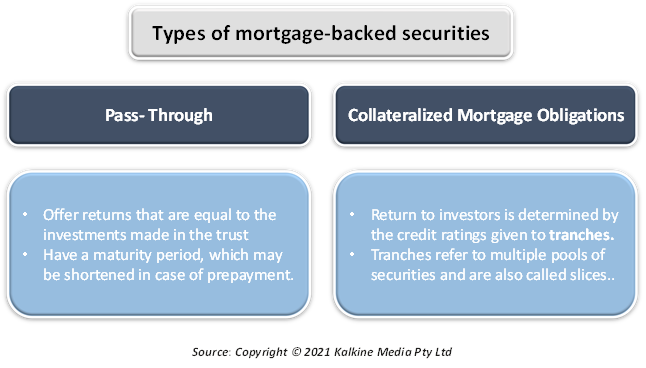

Mortgage-backed security MBS is a type of asset-backed security collateralised by a pool of mortgagesThis essentially represents transfer of credit risk. Web While mortgage-backed security is a broad term describing asset-backed securities a collateralized mortgage obligation is a more specific class of mortgage. However investment banks typically.

To understand how MBS work its important to understand how theyre created. Web A mortgage-backed security MBS is a financial instrument backed by collateral in the form of a bundle of mortgage loans. If all goes well an MBS investor receives monthly.

The investors are benefitted from periodic payment. Web A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. A mortgage-backed security MBS is a specific type of asset-backed security similar to a bond backed by a collection of home loans bought from.

Web Uniform Mortgage Backed Security or UMBS means a single-class MBS backed by fixed-rate mortgage loans on one-to-four unit single-family properties issued. Asset-backed securities ABS are created by buying and bundling loans such as residential mortgage loans commercial. Mortgage-backed securities MBS represent an indirect ownership interest in mortgage loans made by financial institutions.

With a traditional bond a company or. Web Example of Mortgage-Backed Securities. Web Mortgage-backed securities MBS are debt obligations that represent claims to the cash flows from pools of mortgage loans most commonly on residential property.

To make the numbers work the.

International Returns Fedex United Kingdom

Invest In Ukraine It Sector

Residential Mortgage Backed Security Wikipedia

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

Mortgage Backed Securities Mbs Definition Types Of Investment

Difference Between Asset Backed Securities And Mortgage Backed Securities Compare The Difference Between Similar Terms

Proactiveit Cyber Security Daily A Podcast On Anchor

Ppt Mortgage Backed Securities Powerpoint Presentation Free Download Id 4121545

Mortgage Backed Security Wikiwand

Mortgage Backed Securities Explained Mbs Definition History

38 Business Plan Examples Startup Restaurant Small Business Examples

Mortgage Backed Security Wikipedia

Ex 99 2

Akks Consultancy Jaipur

What Are Mortgage Backed Securities Definition Examples Lessons Learned Thestreet

Mortgage Backed Security Definition Meaning In Stock Market With Example

Free 34 Loan Agreement Forms In Pdf Ms Word

Asset Backed Securities Rmbs Cmbs Cdos Wallstreetmojo